…because I love gold AND only in the will-never-be-repeated-ultra-cool early-to-mid 60s could you get away with a movie character named Pussy Galore that’s NOT in a porn movie…

Gold spot closed at $1269.20 today. December’s contracts closed even higher ($1271.70). That puts it well over it’s previous high. Silver closed over $20. Gold closing above it’s previous resistance is a big deal if you are chart/technical trader. I am not. I used to love to trade commodities but it will give you gray hair and an ulcer. This is what makes it both fun and unhealthy long term :)

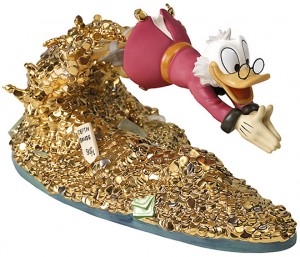

I have been buying gold and silver as an investment for years now. I don’t buy the ETFs, I buy the physical coins. I do buy mining stocks too but for the metals – I want something I can hold. I’m not a crazed goldbug (although I love a good government conspiracy theory!) but I’m a firm believer in wanting the physical metal in my possession (well..at least in my safe deposit box’s possession) and not in the form of a piece of paper. Plus then you can take it out and play in it like Scrooge McDuck

I started buying gold and silver coins a long time ago. A few a year – not like I own Fort Knox or anything (THAT would be cool!) I like the reality of it. I can hold it in my hand. And I can sell it anytime. Stocks are fun, and I am a huge believer in the capital markets, but they don’t have this exact quality. I do not buy coins for their numismatic qualities – I know less than nothing about coin collecting. I buy for the pure commodity of it. But I stick with gold and silver. No platinum (except jewelry!!), copper, palladium, etc.

For sure, gold has had a HUGE run up. Many nay-sayers believe it will come back down and point you to the run-ups of the past. “It’s topped out, will crash, blah, blah.” But this is a different world and economy that we live in than 10 years ago. Than in the 70s. China and India are fast becoming very large economies with a growing upper and middle class that has disposable income and culturally they both love owning gold.

At sushi lunch a few months back, a retired lawyer was talking to my husband and me about the economy. He scoffed at gold buyers because he said the only reason the price went up is because of the paranoia of goldbugs over the economy. When I pointed out that the fact that China also just started allowing, and even advocating, its citizens to buy and own gold, all he had to say was “oh…really?” Yeah. Not just for the Mulders or Lone Gunmen out there anymore…

But yes, I’m sure plenty of people bought into gold for economic fear reasons. It has been the safe haven hedge for a long time now. And also to ride the wave up as retail buyers tend to do after fund managers take huge positions in anything. You can tell from all the ads for gold on TV, the radio, online that it’s aimed at the little guy now. I’m also sure there was a lot of short covering today after it blew through previous resistance of $1260. But it’s simply a different market (and world) now too. More buyers equals more demand.

Might it go back down from today’s newly-minted (see what I did there?!=geek on multiple levels!) high – likely. Funds take profits. Fact of life. Might it create new highs after that? Probably. (see…I can totally be a money-honey on CNBC too – never say it WILL, only it MIGHT or COULD!) So far the overseas markets are flat – keeping spot as it’s high. Of course, in commodities this changes fast so who knows where it will be when I wake up.

Oh, but please do not liquidate your portfolio or take out a loan to buy it (actual questions I get asked as our company’s 401k administrator…) It’s still speculative. This isn’t the California gold rush people (see why I like my 49ers!) But if you want to hedge your stocks or other investments, I personally have always felt it was a good one. I’m like Yukon Cornelius – always looking :) (totally love the song Silver and Gold too!)

And what will happen if the Republicans don’t get the little known detail that was “slipped” into Obama’s HEALTHCARE (?) bill that will require brokers to file 1099s for gold and silver bullion/coins purchases over $600 scratched? Who knows? But I don’t see it slowing down any demand. Just might create a shadow market.

I don’t trade my gold like my stock account (so usually only check open and close prices but today was a hot day.) I buy it and hold it like my 401k. And someday, I might sell it. So I watch these daily ups and downs and listen to the analysts dissect it and just smile and think to myself that I am happy I started buying it before it was “the rage” with a little “well done” pat on my back. Husband used to think my “little hobby” was silly and likely a waste of money that could be invested elsewhere. Then recently a very successful investment banker friend of his told him he does the same thing. Now I’m not so silly after all. Pfft. Men…

Now if I could just build my panic/safe room, I could move it from my bank’s safety deposit box to my house and play it in…just like Scrooge McDuck… ;)

My father used to read me those Disney stories as a kid and Scrooge McDuck was always one of my favorite Disney characters – maybe we are formed from a young age :)

5:12 am on September 15th, 2010

You’re smart. I’ve been reading that too. But then again gold has always been a big deal to Italians (I mean Italian Canadians ;) gold and real estate. While the real estate market has really taken a hit in the US it hasn’t in Canada.

And I agree – it’s fun to hold them in your hands. Very tactile. Maybe you should change your moniker to SMcDuck or Goldfinger! Ha! ;)

5:26 am on September 15th, 2010

[…] a99kitten’s Musings » Blog Archive » Goldfinger IS my favorite … Silver closed over $20. Gold closing above it’s previous resistance is a big deal if you are chart/technical trader. I am not. I used to love to trade commodities but it will give you gray hair and an ulcer. This is what makes it both . […]

5:01 am on September 16th, 2010

I liked From Russia with Love more but goldfinger is great – Alotta Fagina would have been a better name. :)

I agree with you – commodities and futures trading is not for the weak hearted! Since gold is a commodity that is used in plenty of things besides jewellery, I doubt that it will come crashing down in value any time soon – I actually have a few bars that were purchased a while ago when the price was ‘depressed’

The argument still goes on whether economies should have their currencies backed by specie or continue the monetary policy of full faith and credit.

Oops – didn’t mean to turn this into a segment on Squawk Box.