From the Berkshire Hathaway Annual Meeting. Being live blogged by the WSJ: http://blogs.wsj.com/deals/2011/04/30/live-blog-the-berkshire-hathaway-annual-meeting/#

“Gold bugs, don’t read this:

Buffett harps on and on about gold. He says it has no utility, and about how silly people are who are getting in now — when gold prices are near nominal highs. “There’s no question that rising prices…can start affecting behavior,” Buffett said. “People like to get in on things that are rising in prices. Over time, it has not been the way to get rich.”

He’s listing all the things he’d rather have than all the gold in the world, because all you can do with gold is admire it or, as he says, “fondle it.”

Munger repeats what he’s said previously that gold investors are preying on fears. Gold is considered a safe haven investment, because investors tend to flock to buying gold assets when they’re freaked out about the health of other assets and the economy.”

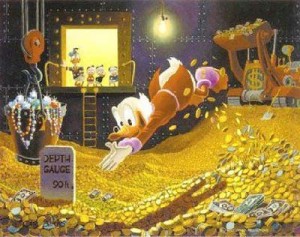

Umm…duh! :) I love you Warren but I want my gold and silver exactly so that I can fondle it on demand! And keep the value safely in a lock box and not a company’s balance sheet. It’s called a hedge for a reason. Also I want to do this someday:

But yes, it is at an all-time high (well, not if adjusted for inflation – we are still way off of that number which is something to keep in mind) so it does seem silly to jump in with 2 feet now. Except that financial experts and the media have been saying that since gold hit $1000 (2009.) So who knows. It’s called speculation for a reason. And I happily did not sell any after all the “experts” said it will go down from here last summer (when it hit $1250.) It’s now over the big $1500 mark. Plus I do think that China especially is playing a huge role in its run up so it’s not just a bunch of crazed gold bugs stocking their underground bunkers with gold coins, guns and MREs (not that there’s anything wrong with that.) Between China and India, you have a lot of new money going into the purchase of it. And both cultures value it highly. So it’s not quite the same market conditions as when it went crazy in the late 70s only to crash (ish).

And yes, most of the ads for it are definitley aimed at cashing in on people’s fears. Kinda like the earthquake & flood insurers advertising after a disaster (cough *Geico*) or oil traders after some backwards Middle Eastern country has an uprising. Or flu shot ads at the drugstore right before flu season. As long as investors (buyers) understand that, it’s not a bad thing. And if they don’t understand it, they should keep their money safely in a barely-interest paying CD.

So Mr. Buffett, I love you and trust you. But I will happily disagree with you on this. I believe you don’t like technology companies much either (you and Bill must argue about that one!) So that’s why you are ONE of my investments but not all.

But please…stay alive for 50 more years. We do need you!!!

12:22 pm on May 2nd, 2011

I used to admire him, but that ‘aww shucks’ folksy crap has grown old – especially with the sweetheart deal he got for the Goldman preferred stock on the taxpayers’ backs. Sure he’s going to rail against speculation because he gets to invest in the ‘sure thing’ while everyone else has to hang around for the crumbs.

I bet the Lubrizol dustup was more the norm than not. He is always going to get a pass from the regulators because he is who he is.

7:12 pm on May 2nd, 2011

Well, I automatically assume the rich get richer by knowing the rich and dealing with the rich and everyone washes each other’s hands, or backs or however that goes :)